By Blessing Chinagorom

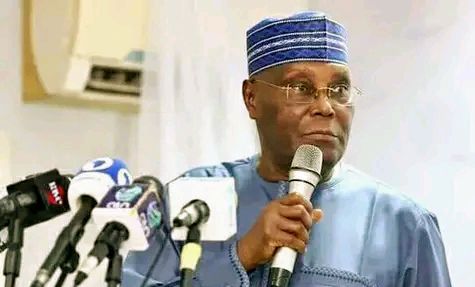

Former Nigerian Vice President, Abubakar Atiku has kicked against a move by the Federal Government to rev up economic growth by unlocking N20 trillion from the nation’s pension funds and other funds to finance critical infrastructure projects across the country.

The 2023 People’s Democratic Party Presidential Candidate who opposed the moves on his social media platforms said the federal government do not give useful detail, such as the percentage of the funds to be mopped up from the Pension Funds, etc.

Atiku urged the Government to halt the move, saying it is a misguided initiative that could lead to disastrous consequences on the lives of Nigeria’s hardworking men and women who toiled and saved and who now survive on their pensions having retired from service.

The ex-Vice President said this move is another attempt to perpetrate illegality by the Federal Government, adding that the govt must be cautioned to act strictly within the provisions of Pension Reform Act of 2014 (PRA 2014), along with revised Regulation on Investment of Pension Assets issued by the National Pension Commission (PenCom).

He said in particular, the Federal Government must not act contrary to the provisions of the extant Regulation on investment limits to wit: Pension Funds can invest no more than 5% of total pension funds’ assets in infrastructure investments.

Atiku noted that as of December 2023, total pension funds assets were approximately N18 Trillion, of which 75% of these are investments in FGN Securities, saying there is no free Pension Funds that is more than 5% of the total value of the nation’s pension fund for Mr. Edun to fiddle with.

According to him, “There are no easy ways for Mr. Edun to address the challenges of funding infrastructure development in Nigeria. He can’t cut corners.  “He must introduce the necessary reforms to restore investor confidence in the Nigerian economy and to leverage private resources, skills, and technology”, Atiku concluded.

“He must introduce the necessary reforms to restore investor confidence in the Nigerian economy and to leverage private resources, skills, and technology”, Atiku concluded.

It was reported that the Coordinating Minister for the Economy and Minister of Finance, Wale Edun disclosed this at the end of the federal executive council (FEC) meeting chaired by President Bola Tinubu.

According to the Cable, Edun said the government is focused on tapping into domestic financial resources, particularly pension and life insurance funds, to leverage local funds for national growth.

He added that it was a significant step towards driving economic progress and addressing critical infrastructure needs.

Edun said, “With over N20 trillion available funds within the country, there is a clear opportunity to channel these resources into vital sectors such as housing and long-term mortgage provision”.

The Minister added the move is part of the government’s efforts to bridge Nigeria’s estimated 20 million housing deficits and to provide massive housing and mortgage loans at 12 percent interest rates, with 25-year repayment plans.

“And the fact is that even before we start looking to foreign investors, we start looking to foreign funding, there is available in Nigeria, long term funds to fund infrastructure projects, and it’s within the pension, the life insurance and investment fund industry generally,” he said.